Fillable Form Pay Stub

Pay stub, payslip, pay advice, or paycheck stub is a document an employee receives either as a notice that the direct deposit transaction has gone through, or is attached to the paycheck.

What is a Pay Stub?

A pay stub, payslip, or paycheck stub, is a document that an employer attaches to an employee’s paycheck on a payday. It contains information about an employee’s compensation, itemizing the wages earned for a pay period and year-to-date payroll.

Pay Stubs can be in the form of an electronic or printed document. Nevertheless, it must show taxes, deductions, contributions, and the net pay or amount the employee receives. Using this file, employees can make sure that they are paid appropriately. Employers, on the other hand, can use it to settle any salary discrepancies. In addition, they may use it to fill out an employee’s Form W-2 during a tax filing period.

When an employee is paid with a paper check, his or her pay stub is usually attached to the paycheck. For salaries directly deposited to a bank account, an employee’s pay stub is usually available online if a paper copy is not provided by the employer.

Federal labor laws do not require companies to issue pay stubs to their employees; however, many states have laws and regulations that require employers to provide a written pay statement for the protection of employees.

How to Fill Out a Pay Stub?

Filling out a pay stub is simple. Once you are done with the computation of an employee’s earnings and deductions for a pay period, the next step is to complete his or her paystub. Use the following guide:

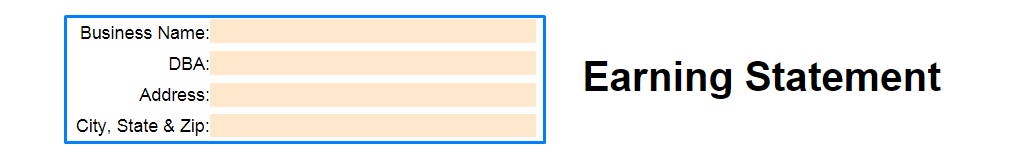

Business Name asks for the employer’s official business name.

Address asks for the employer’s business address.

City, State, & ZIP asks for the city, state, and ZIP of the business.

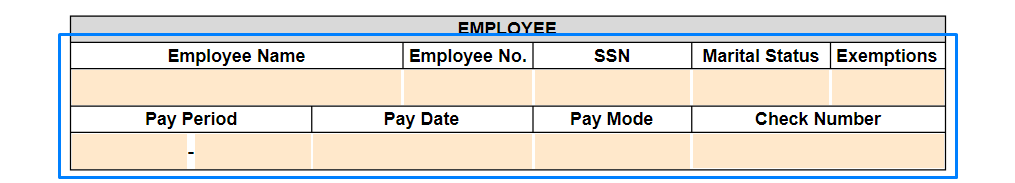

Employee Name asks for the full legal name of the employee.

Employee No. asks for the employee’s number in the company.

SSN asks for the employee’s Social Security Number.

Marital Status asks for the employee’s marital status.

Exemptions asks for any income-related exemptions that the employee may have, if applicable.

Pay Period indicates the pay period the pay stub was created.

Pay Date indicates the pay date that the pay stub was given.

Pay Mode indicates the mode that the payment was given.

Check Number indicates the check number given to the employee, if applicable.

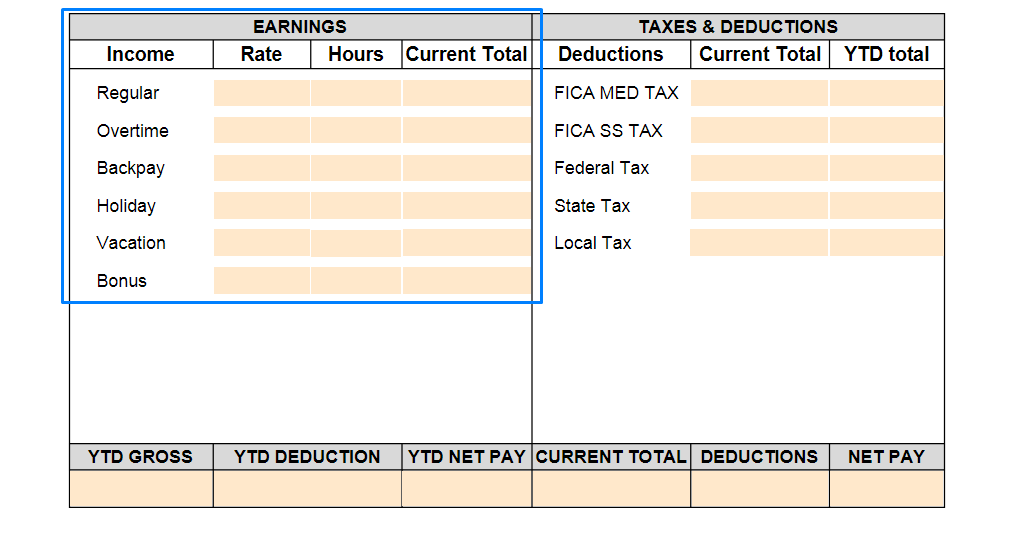

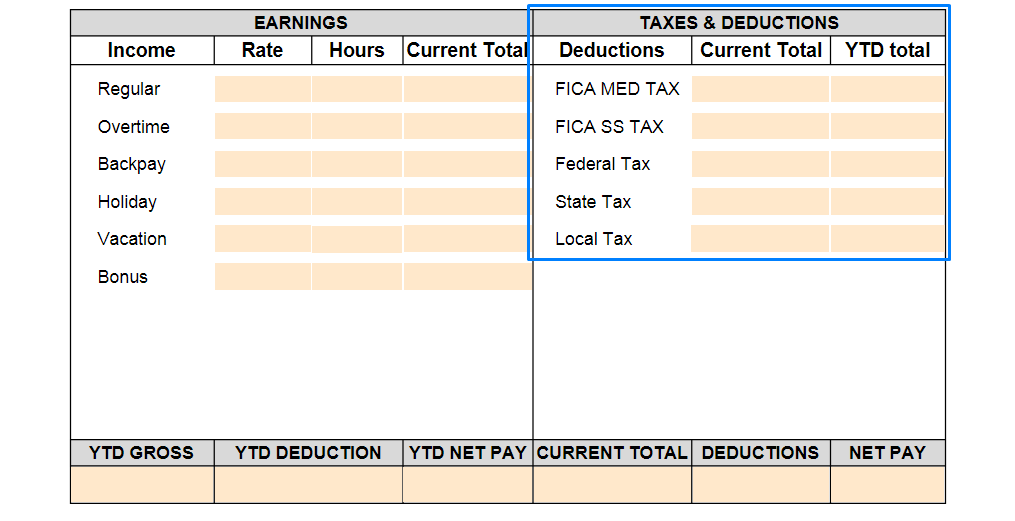

Earnings indicates the types of income the employee has earned, as well as the respective rates, hours worked, and current total.

Taxes and Deductions indicates the types of taxes and deductions the employee has, as well as the respective current total and year-to-date total.

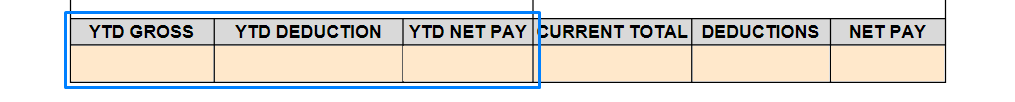

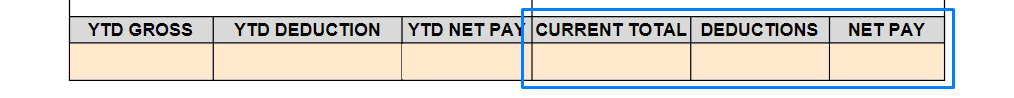

YTD Gross indicates the employee’s year-to-date gross income.

YTD Deduction indicates the employee’s year-to-date deduction.

YTD Net Pay indicates the employee’s year-to-date net pay.

Current Total indicates the employee’s current total earnings for the pay period.

Deductions indicates the employee’s total deductions for the pay period.

Net Pay indicates the employee’s net pay for the pay period.

Keywords: pay stub pay-stub pay stub template pay stub download fillable pay stub